Amman – Jordan’s 2025 economic performance has revealed a qualitative shift in the Kingdom’s investment attractiveness, with the Ministry of Investment successfully leading the economic modernization drive by institutionalizing procedures and removing obstacles facing both domestic and foreign capital. These efforts have translated into record results in investment inflows and growing international confidence.

Economic data and indicators for 2025 point to a strategic transformation in Jordan’s investment climate, as legislative and procedural reforms have moved the environment from a phase of structural planning to one of tangible outcomes and measurable gains.

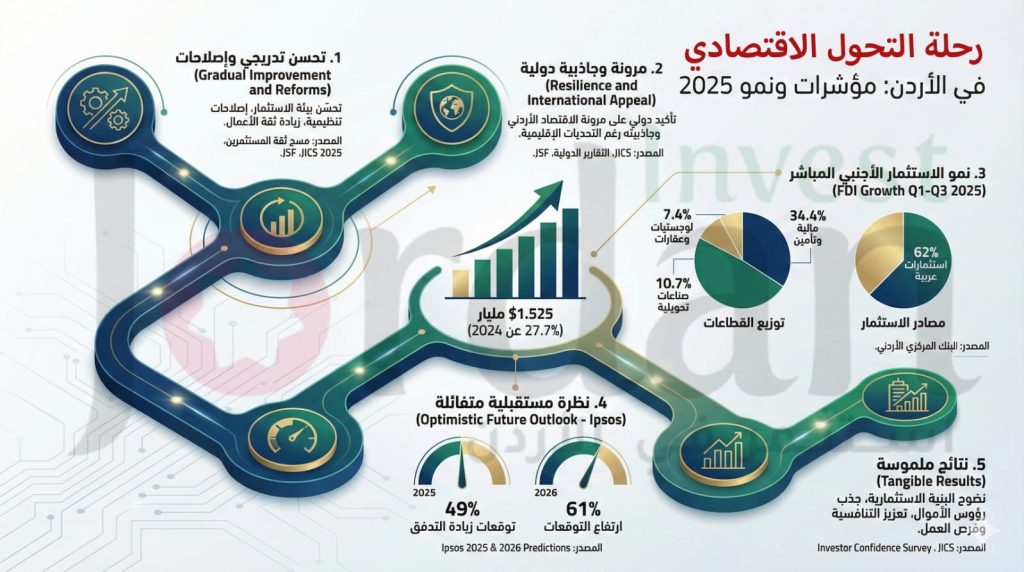

Surge in Capital Inflows and International Endorsements of Economic Resilience

According to the latest data from the Central Bank of Jordan, foreign direct investment recorded a notable increase during the first three quarters of the year, reaching USD 1.525 billion—an increase of 27.7% compared to the same period in 2024. Reports indicate that Arab investments accounted for the largest share, representing 62% of total inflows, reflecting strong economic ties and growing regional confidence in the Jordanian market.

Sectoral distribution data show that the financial and insurance sector led investment inflows with a share of 34.4%, followed by manufacturing industries at 10.7%, and logistics and real estate at 7.4%. Analysts note that the concentration of investments in these sectors enhances value creation and contributes directly to sustainable job creation.

On financial resilience, international credit rating agencies and global organizations agreed in the Jordan Investment Climate Statement 2025 that the national economy has demonstrated strong resilience and a sustained ability to maintain investment attractiveness and stable future outlooks, despite prevailing regional challenges. The reports emphasized that the credibility of Jordan’s reform trajectory has been a cornerstone in reinforcing confidence among the international business community.

Rising Optimism for 2026 and a Maturing Competitive Environment

In a related context, Ipsos recorded a significant improvement in the Investment Expectations Index, with the share of experts and investors anticipating increased international investment inflows rising from 49% in 2025 to 61% for 2026. This increase reflects a shift from cautious anticipation to a stable and positive forward-looking outlook.

Reports by the Jordan Strategy Forum and the Investor Confidence Survey concluded that 2025 represents a phase of “gradual maturity” for Jordan’s investment framework, where capital attraction has been accompanied by tangible solutions to operational challenges. This alignment has enhanced Jordan’s competitiveness as a safe and stable regional hub for investment.

Sources: Central Bank of Jordan | Jordan Strategy Forum | Ipsos Global Report | Investor Confidence Survey 2025